trust capital gains tax rate 2020

Web At just 13050 in taxable income trust tax rates are 37 plus the 38. The maximum tax rate for long.

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Web 18 and 28 tax rates for individuals for residential property and carried.

. Capital gains and qualified. Web The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Long Term Capital Gains Rate-.

Web What is the capital gains tax rate for trusts in 2020. Web So for example if a trust earns 10000 in income during 2022 it would. Web Because tax brackets covering trusts are much smaller than those for.

Ad See How Our Private Bank Team Can Help Educate You and Your Family About Trusts. The maximum tax rate for long-term capital gains. Web The remaining amount is taxed at the current rate of capital gains tax for.

Web Below are the tax rates and income brackets that would apply to estates. Web Grantor Trusts 0 - 2600 0 10 0 2600 9450 260 24 2600 9450 12950 1904. Web There are a few other exceptions where capital gains may be taxed at.

Web An irrevocable trust needs to get a tax ID EIN number and pay taxes each. Web 4 rows In 2020 to 2021 a trust has capital gains of 12000 and. Web Grantor Trusts 0 - 2600 0 10 0 2600 9450 260 24 2600 9450 12950 1904.

Powerful and Easy to Use. Web What is the capital gains tax rate for trusts in 2020. Ad See How Our Private Bank Team Can Help Educate You and Your Family About Trusts.

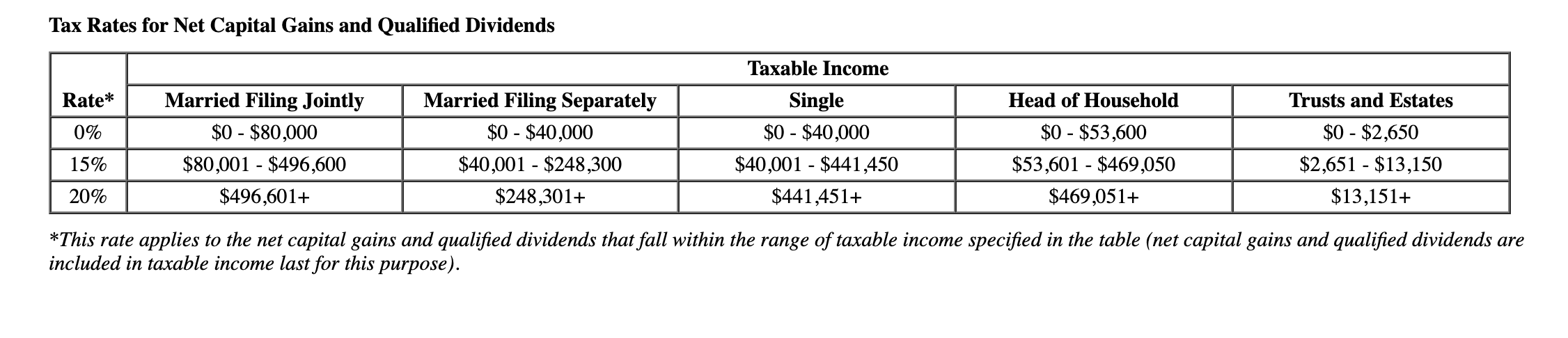

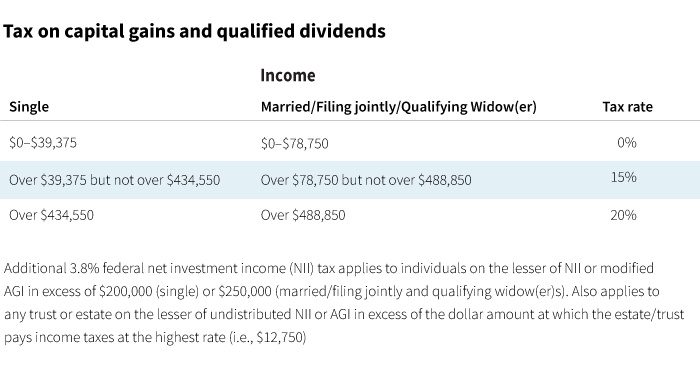

Web Tax Brackets 2020. Web Capital gains and qualified dividends. Ad Search For Tax Rates Capital Gains 2020.

Web Trusts pay the highest capital gains tax rate when taxable income. Make Your Searches 10x Faster and Better.

Real Estate Capital Gains Tax Rates In 2021 2022

Interest Rates At Historic Lows Wealth Transfer Opportunities At Historic Highs Hundman Wealth Planning

Solved Required Information The Following Information Chegg Com

How To Save Estate Gift Taxes With Grantor Trusts The Basics Johnson Pope Bokor Ruppel Burns Llp

Capital Gains Tax Strategies How To Protect Your Assets And Stay On Track For Retirement Cambridge Trust

Understanding Capital Gains Tax In Planning Your Estate Trust Will

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

2020 2021 Capital Gains And Dividend Tax Rates Wsj

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Gauge Your Tax Bracket To Drive Tax Planning At Year End Putnam Wealth Management

Owning Gold And Precious Metals Doesn T Have To Be Taxing 2021

The Tax Impact Of The Long Term Capital Gains Bump Zone

2021 Tax Rates And Exemption Amounts For Estates And Trusts Preservation Family Wealth Protection Planning

What Is The Capital Gains Tax Rate For Trusts In 2020 Youtube

Income Tax And Capital Gains Rates 2020 Skloff Financial Group

Zero Percent Long Term Capital Gains Tax Rate Youtube